"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

01/09/2019 at 15:11 • Filed to: None

0

0

39

39

"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

01/09/2019 at 15:11 • Filed to: None |  0 0

|  39 39 |

are all sorts of fucked up at the moment. My parents took their Insight home last night and I dug through the paperwork like any nosey son would, they got a 5.9% interest rate through Honda which made my jaw drop. For reference my dad has a 880 score with multiple cars paid off and a house paid on it as well.

On another note, Insight review coming this weekend.

Nothing

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Nothing

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:20 |

|

Is that through the manufacturer? Toyota didn’t have any good rates for 2019, so I went through a credit union, then USAA came out with better rates so I just refinanced through them. Still, 3% a couple of years ago and I might have walked out of the dealership.

AddictedToM3s - Drives a GC

> Supreme Chancellor and Glorious Leader SaveTheIntegras

AddictedToM3s - Drives a GC

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:21 |

|

That’s is crazy. The only thing I can think of is they want to front load the interest since your dad’s credit is so high they factor in he will probably pay it off way before the life of the loan ends.

ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

> Supreme Chancellor and Glorious Leader SaveTheIntegras

ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:22 |

|

Sounds like they got soaked by the dealership. Could they have used a credit union?

Highlander-Datsuns are Forever

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Highlander-Datsuns are Forever

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:25 |

|

My last car loan was 1.9%. I don’t expect it to be that good on my next loan.

Akio Ohtori - RIP Oppo

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Akio Ohtori - RIP Oppo

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:25 |

|

That is insane!

More Power!!and also some brakes.

> Supreme Chancellor and Glorious Leader SaveTheIntegras

More Power!!and also some brakes.

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:26 |

|

Jesus H. I got 2% on my Corvette through my credit union.

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Nothing

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Nothing

01/09/2019 at 15:29 |

|

Yes it’s through Honda. Wells Fargo was 6%; theyre going to refinance immediately

Supreme Chancellor and Glorious Leader SaveTheIntegras

> AddictedToM3s - Drives a GC

Supreme Chancellor and Glorious Leader SaveTheIntegras

> AddictedToM3s - Drives a GC

01/09/2019 at 15:29 |

|

Yeah the car’s gonna be paid off well before

Supreme Chancellor and Glorious Leader SaveTheIntegras

> ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

Supreme Chancellor and Glorious Leader SaveTheIntegras

> ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

01/09/2019 at 15:29 |

|

Yeah theyre going to refinance through a local credit union

DAWRX - The Herb Strikes Back

> Supreme Chancellor and Glorious Leader SaveTheIntegras

DAWRX - The Herb Strikes Back

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:29 |

|

When we bought my wife’s Civic in June the best we could get was 2.99%. I had a paid off vehicle, m y credit score was just over 800, and my wife’s was mid to high 700s. I had a 1.9% rate when I bought my WRX 3 years prior, and I was a first time car buyer with not much credit history. I really thought I was getting scammed when they told me they couldn’t do any better.

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Highlander-Datsuns are Forever

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Highlander-Datsuns are Forever

01/09/2019 at 15:30 |

|

I improved at least, went from 10 as a first time buyer to 5.69

E90M3

> Supreme Chancellor and Glorious Leader SaveTheIntegras

E90M3

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:30 |

|

Isn’t an 850 a perfect FICO score thought?

CobraJoe

> Supreme Chancellor and Glorious Leader SaveTheIntegras

CobraJoe

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:32 |

|

I got a 6.5% rate on the loan I got last year. Banks do not like to give good financing for 13 year old vehicles.

Still though, one year later and I’m pretty sure I could sell it today and end up owing nothing. It feels a lot better having a loan when you’re not overwhelmingly owing more than the worth of the vehicle.

Highlander-Datsuns are Forever

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Highlander-Datsuns are Forever

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:33 |

|

My first car loan was 7%, that was 2002 when

rates were IIRC 4% plus prime.

KingT- 60% of the time, it works every time

> Supreme Chancellor and Glorious Leader SaveTheIntegras

KingT- 60% of the time, it works every time

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:35 |

|

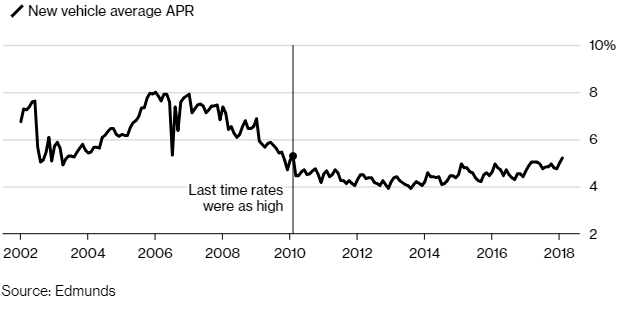

They have gone up since 2014. This is data as of Feb 2018:

https://www.statista.com/statistics/290673/auto-loan-rates-usa/

I remember the days of 1.9% and even 0.99% loans. My car is currently financed through Infiniti at 0.9% for 3 years but that’s a CPO special rate , almost makes me dread interest rates when I buy the next car a few years from now.

Even manufacturer new car rates are shitty now, compared to few years ago.

Mortgage rates are up too. We got lucky and financed at 2.7 % 2 years ago

Die-Trying

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Die-Trying

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:35 |

|

i can already imagine YOU gathering up your folks to have “the discussion” about credit and responsibility that THEY should of been giving to you. with extra emphasis on credit scores and rates that should come with them........... all followed by a “you blew it”, or “you let me down”, dad.........

yeah, i know some folks either just dont know, or dont care that much......

KingT- 60% of the time, it works every time

> Highlander-Datsuns are Forever

KingT- 60% of the time, it works every time

> Highlander-Datsuns are Forever

01/09/2019 at 15:39 |

|

First car loan with a job just out of c ollege was 12%, didn’t have savings so couldn’t pay cash upfront but I needed something better than a $1500 beater I had then. Grit my teeth and waited a year for scores to go up and refinanced for a more acceptable 6.5%

Highlander-Datsuns are Forever

> KingT- 60% of the time, it works every time

Highlander-Datsuns are Forever

> KingT- 60% of the time, it works every time

01/09/2019 at 15:43 |

|

I would expect that, I was 3 years out of school. My second loan was 4% at carmax and my 3rd was 1.9% chase through subaru financial

.

KingT- 60% of the time, it works every time

> Highlander-Datsuns are Forever

KingT- 60% of the time, it works every time

> Highlander-Datsuns are Forever

01/09/2019 at 15:46 |

|

Current loan on the G is 0.9%. I will never get that again nor will that rate be ever offered again on a used (CPO) car. Almost makes me want to keep this thing forever

Supreme Chancellor and Glorious Leader SaveTheIntegras

> DAWRX - The Herb Strikes Back

Supreme Chancellor and Glorious Leader SaveTheIntegras

> DAWRX - The Herb Strikes Back

01/09/2019 at 15:51 |

|

Honda is doing 2.9-3.9 for civics still, everything else is a big “fuck you” apparrntly

Supreme Chancellor and Glorious Leader SaveTheIntegras

> E90M3

Supreme Chancellor and Glorious Leader SaveTheIntegras

> E90M3

01/09/2019 at 15:52 |

|

Idk what he had exactly, but its over 800. Everything above 750 is all the same to banks

bhtooefr

> Supreme Chancellor and Glorious Leader SaveTheIntegras

bhtooefr

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 15:52 |

|

Wow.

I got 1.66% 2.5 years ago, with an >800 score. ...of course, I did shop around, and brought a 1.99% offer with me...

Mercedes Streeter

> Highlander-Datsuns are Forever

Mercedes Streeter

> Highlander-Datsuns are Forever

01/09/2019 at 15:56 |

|

My first car loan (a lease) was at 6.7%. When I financed at lease-end it went down to 5%. The charged off 2016 (no updates on that situation) was 0%.

BeaterGT

> CobraJoe

BeaterGT

> CobraJoe

01/09/2019 at 16:02 |

|

Banks don’t but credit unions do! 1.9% on my 17 year old car.

BeaterGT

> More Power!!and also some brakes.

BeaterGT

> More Power!!and also some brakes.

01/09/2019 at 16:03 |

|

Same here! Savings account earns more money than the loan accrues interest.

E90M3

> Supreme Chancellor and Glorious Leader SaveTheIntegras

E90M3

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 16:04 |

|

Everything above 750 is all the same to banks

Unless you’re 23 and trying to borrow 50k.

Arrivederci

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Arrivederci

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 16:07 |

|

That’s pretty high for a new car, but as others have pointed out, rates have been climbing. Money has been too cheap for too long, so overall the increases aren’t a bad thing.

Dr. Zoidberg - RIP Oppo

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Dr. Zoidberg - RIP Oppo

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 16:18 |

|

That’s like pre-recession student-loan bad.

CobraJoe

> BeaterGT

CobraJoe

> BeaterGT

01/09/2019 at 16:47 |

|

I guess your mileage may vary... The credit union we use wouldn’t sway from their advertized

rates, which weren’t great for a used car that old.

Supreme Chancellor and Glorious Leader SaveTheIntegras

> E90M3

Supreme Chancellor and Glorious Leader SaveTheIntegras

> E90M3

01/09/2019 at 16:53 |

|

Yes then you’re just wrong

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Die-Trying

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Die-Trying

01/09/2019 at 16:53 |

|

I shouldve done that but all i did was laugh

BeaterGT

> CobraJoe

BeaterGT

> CobraJoe

01/09/2019 at 16:59 |

|

Yeah and while I used Penfed back then, I couldn’t tell you if they have the best deal with current rates where they are .

Rico

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Rico

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 17:30 |

|

Shop around at credit unions too! Just in case they can get a better rate and might even get WF to match it.

Die-Trying

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Die-Trying

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/09/2019 at 20:10 |

|

its not too late to do the responsible parent thing, where you tell them “you are going to take me to this dealership, and i am going to talk to this guy, whats his name?, and tell him to quit taking advantage of gullible folks like you, and make him FIX this ri diculous rate that he forced on you. now get in the car, we’ re taking it back”............ oh to see the look on THEIR faces.......

whatisthatsound

> Supreme Chancellor and Glorious Leader SaveTheIntegras

whatisthatsound

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/10/2019 at 01:29 |

|

You don’t mean that.

davesaddiction @ opposite-lock.com

> Akio Ohtori - RIP Oppo

davesaddiction @ opposite-lock.com

> Akio Ohtori - RIP Oppo

01/10/2019 at 09:55 |

|

Not really. We’ve been spoiled in recent years.

Banks raised the prime rate when the Federal Open Market Committee raised the current Federal Reserve interest rate to 2.25 percent. The prime rate is three points above the fed funds rate.

davesaddiction @ opposite-lock.com

> Supreme Chancellor and Glorious Leader SaveTheIntegras

davesaddiction @ opposite-lock.com

> Supreme Chancellor and Glorious Leader SaveTheIntegras

01/10/2019 at 10:07 |

|

“ Banks raised the prime rate when the Federal Open Market Committee raised the current Federal Reserve interest rate to 2.25 percent. The prime rate is three points above the fed funds rate.”

They best they’re likely to get anywhere (besides some dealer promotion rate) is 5.25%.

Akio Ohtori - RIP Oppo

> davesaddiction @ opposite-lock.com

Akio Ohtori - RIP Oppo

> davesaddiction @ opposite-lock.com

01/10/2019 at 10:37 |

|

Haha true. My parents tell stories about being proud of their 11% interest rates on their first home or whatever, but still...

davesaddiction @ opposite-lock.com

> Akio Ohtori - RIP Oppo

davesaddiction @ opposite-lock.com

> Akio Ohtori - RIP Oppo

01/10/2019 at 10:42 |

|

Yup. My home loans in the past ~15 years were like 6.5, 4.75, 3.75, 3.125 and 3.5, and the loan on my (used) M3 in 2012 was 3%. Could’ve had a 1.9% promotional rate on my Tacoma, but I took the cash.